Simply Solar Illinois - Questions

Table of ContentsThe smart Trick of Simply Solar Illinois That Nobody is Talking AboutLittle Known Facts About Simply Solar Illinois.The Ultimate Guide To Simply Solar IllinoisSimply Solar Illinois Things To Know Before You BuyGetting The Simply Solar Illinois To Work

Our group companions with local areas throughout the Northeast and beyond to provide tidy, economical and trusted power to cultivate healthy neighborhoods and maintain the lights on. A solar or storage project delivers a variety of advantages to the area it serves. As technology developments and the cost of solar and storage space decline, the financial advantages of going solar remain to rise.Assistance for pollinator-friendly habitat Environment repair on infected sites like brownfields and land fills Much needed shade for animals like sheep and poultry "Land banking" for future agricultural use and dirt high quality renovations Because of climate adjustment, extreme weather condition is ending up being a lot more frequent and disruptive. Because of this, house owners, services, neighborhoods, and utilities are all coming to be increasingly more interested in protecting energy supply remedies that use resiliency and energy security.

In 2016, the wind power market straight employed over 100,000 full-time-equivalent employees in a range of abilities, including manufacturing, task growth, building and wind turbine installment, procedures and maintenance, transport and logistics, and financial, lawful, and consulting solutions [10] Greater than 500 factories in the United States manufacture parts for wind generators, and wind power project installments in 2016 alone represented $13.0 billion in investments [11] Ecological sustainability is an additional crucial driver for businesses purchasing solar power. Numerous firms have durable sustainability goals that consist of lowering greenhouse gas exhausts and utilizing less sources to assist reduce their impact on the native environment. There is a growing seriousness to deal with environment adjustment and the stress from consumers, is reaching the leading degrees of organizations.

The Buzz on Simply Solar Illinois

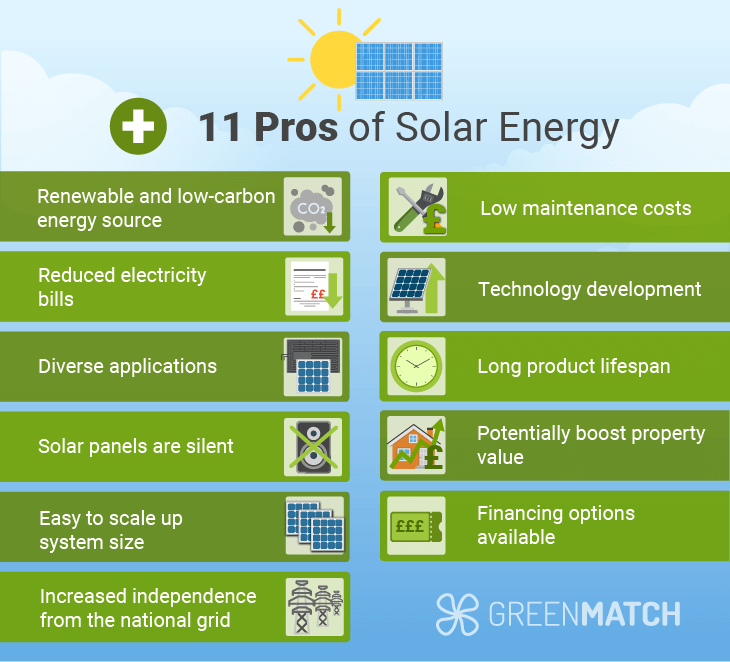

As we come close to 2025, the assimilation of photovoltaic panels in business tasks is no more simply an alternative yet a strategic need. This blogpost explores exactly how solar power works and the diverse benefits it offers industrial structures. Solar panels have been used on property structures for years, but it's just lately that they're becoming extra common in business building.

It can power lights, heating, cooling and water heating in business buildings. The panels can be installed on roofs, auto parking whole lots and side yards. In this article we discuss how solar panels work and the benefits of utilizing solar power in commercial structures. Electricity expenses in the united state are boosting, making it much more costly for businesses to operate and extra difficult to intend ahead.

The U - Simply Solar Illinois.S. Power Info Management expects electric generation from solar to be the leading resource of development in the U.S. power market through completion of 2025, with 79 GW of new solar capability predicted ahead online over the following two years. In the EIA's Short-Term Power Expectation, the company claimed it expects sustainable energy's total share of electrical energy generation to climb to 26% by the end of 2025

Excitement About Simply Solar Illinois

The photovoltaic or pv solar cell absorbs solar radiation. The cables feed this DC electrical Check Out Your URL energy right into the solar inverter and convert it to rotating power (AC).

There are numerous methods to save solar power: When solar energy is fed right into an electrochemical battery, the chemical response on the battery parts maintains the solar power. In a reverse response, the present exits from the battery storage for consumption. Thermal storage makes use of mediums such as liquified salt or water to retain and soak up the warmth from the sunlight.

Solar panels dramatically lower power expenses. While the initial investment can be high, overtime the expense of mounting solar panels is recovered by the cash saved on electrical energy expenses.

What Does Simply Solar Illinois Do?

By mounting photovoltaic panels, a brand reveals that it appreciates the setting and is making an effort to reduce its carbon impact. Structures that count totally on electric grids are at risk to power failures that occur throughout negative weather condition or electric see this site system malfunctions. Solar panels installed with battery systems enable commercial buildings to remain to work throughout power outages.

The Best Strategy To Use For Simply Solar Illinois

Solar power is one of the cleanest types of power. In 2024, house owners can profit from federal solar tax obligation rewards, enabling them to counter nearly one-third of the purchase price of a solar system through a 30% tax obligation credit scores.